If you’ve been in a car accident and you don’t have insurance, you may be wondering how you can recover the costs of the damages. Here are a few options you may want to consider:

- Contact the insurance company of the party at fault for the accident. If the other driver was at fault for the accident, their insurance company may be able to help you recover the costs of the damages.

- File a lawsuit against the party at fault for the accident. If you are unable to reach an agreement with the other driver’s insurance company, you may need to file a lawsuit in order to seek compensation for the damages.

- Consider negotiating a settlement with the party at fault for the accident. If you are unable to file a claim with the other driver’s insurance company or if you are unable to win a lawsuit, you may want to consider negotiating a settlement with the other driver directly.

It’s important to keep in mind that recovering the costs of a car accident with no insurance can be challenging, and you may need to seek legal advice or representation in order to pursue any of the options listed above.

What are the benefits of a not-at-fault claim?

If you’ve been in a car accident and it was not your fault, you may be eligible to make a “not at fault” claim through the insurance company of the party at fault. Here are some potential benefits of making a not-at-fault claim:

- You may be able to recover the costs of damages that you incurred as a result of the accident. This can include repair costs for your vehicle, as well as medical expenses if you were injured in the accident.

- Your own insurance premiums are less likely to increase as a result of the accident. If you make a not-at-fault claim, your insurance company is more likely to cover the damages without raising your premiums.

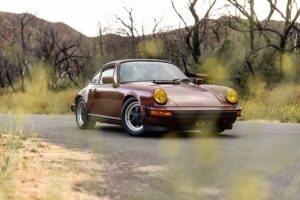

- Making a not-at-fault claim can help you get back on the road more quickly. If your car was damaged in the accident and you need to hire a rental car while it is being repaired, the insurance company of the party at fault may be able to cover the cost of the rental car.

- You may be able to hold the party at fault for the accident accountable for their actions. By making a not-at-fault claim, you can help ensure that the party at fault is held responsible for the damages they caused.

- You may be able to claim a not-at-fault car hire to keep you on the road while the claim is being processed and your car is being repaired.

How to Submit a Not-at-Fault Insurance Claim vs a Standard Claim

There are a few key differences between submitting a “not at fault” insurance claim and a standard claim:

- Not-at-fault claims involve the insurance company of the party at fault for the accident, while standard claims involve your own insurance company.

- Not-at-fault claims are typically made after an accident that was not your fault, while standard claims are made after an accident that was your fault (or partially your fault).

- The process for submitting a not-at-fault claim may involve contacting the insurance company of the party at fault and providing them with details of the accident, while the process for submitting a standard claim involves contacting your own insurance company and providing them with the same information.

Overall, the process for submitting a not-at-fault claim and a standard claim is similar in that you will need to provide your insurance company (or the insurance company of the party at fault) with details of the accident, as well as any documentation of damages or injuries that you incurred as a result of the accident. However, the specific requirements and procedures can vary depending on your insurance policy and the details of the accident. If you have any questions about how to submit a not-at-fault insurance claim or a standard claim, it’s a good idea to contact your insurance company or a not-at-fault claims specialist for more information.